For Business | Flexible Spending Account

Cost-saving FSA solutions for employers

Give your employees more flexibility with a seamless Flexible Spending Account (FSA) experience powered by HealthEquity.

FSA Solutions

Our flexible spending account solutions combine intuitive technology and 24/7 support, enabling a fully customizable experience that empowers employees to achieve financial security and helps you reach business goals.

Customize your FSA

We own our platform so you can offer more flexible health plans that can increase participation, reduce your tax liability, and enhance the member experience.

- FSA + Carryover

- FSA + Grace period

- Dependent Care FSA (DCFSA)

- FSA + Health Reimbursement Account (HRA)

- Limited Purpose FSA (LPFSA) + Health Savings Account (HSA)

Make open enrollment the best time of the year

Our team is laser-focused on your success. We’ve managed the open enrollment experience for millions of members, so we know what works and doesn’t.

- Communicate strategically

- Access educational resources

- Gain new adoptions

- Boost engagement

- Secure re-enrolls

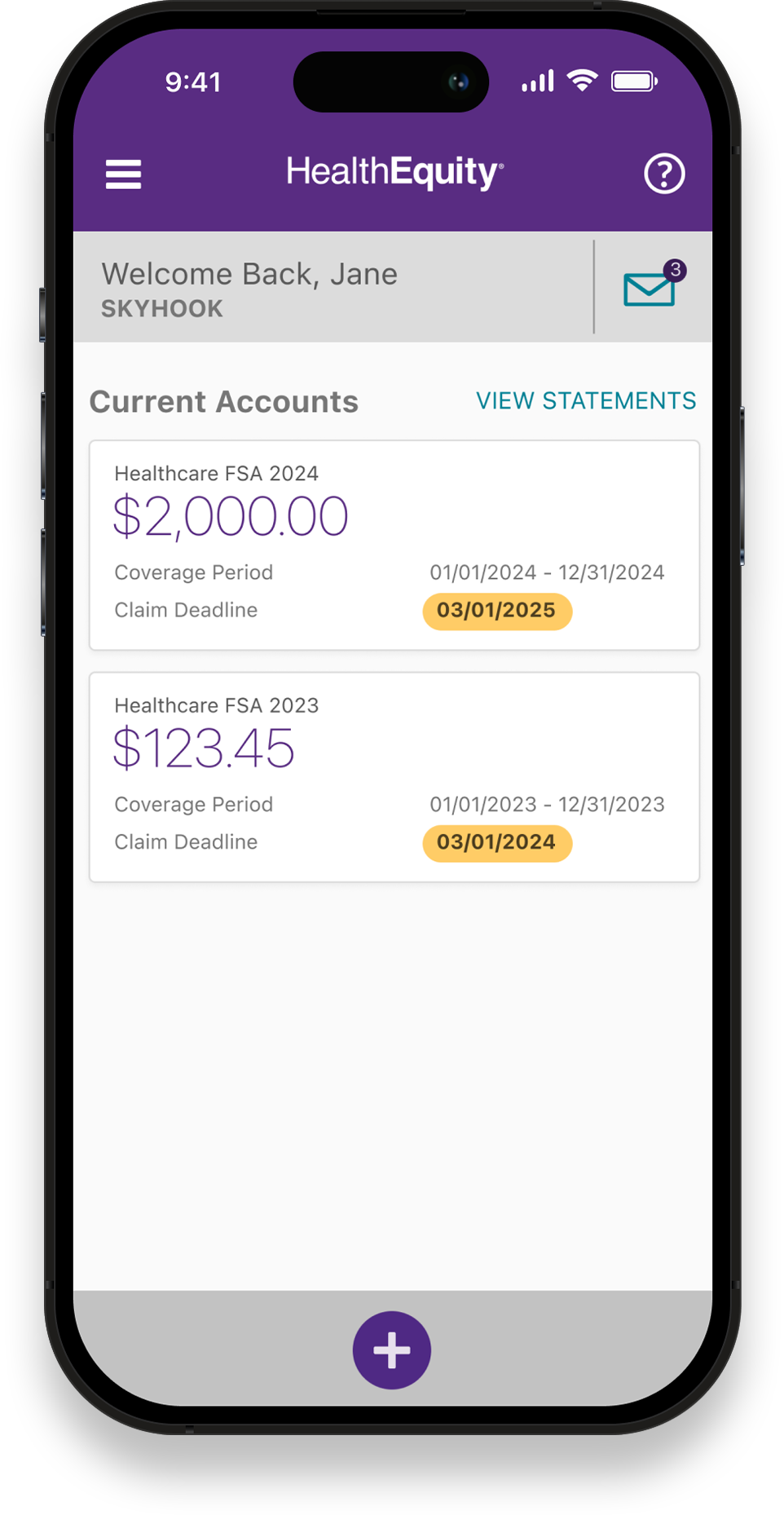

Single-view dashboard

Our unified dashboard lets members perform basic account functions directly from the home screen.

Mobile

Manage everything from the palm of your hand.

Convenient

Enjoy at-a-glance views of account balances, spending, claims status, and more.

Secure

Expect two-factor authentication and industry-standard encryption.

Are you an FSA-eligible employee?

An FSA is an employer-sponsored health savings account that empowers you to set aside pre-tax money from every paycheck to help pay for qualified medical expenses. Check with your employer to see if FSAs are offered as part of their health benefits. What are the advantages of an FSA?

Put more money in your pocket

Access funds at the start of the year

Spend beyond the doctor’s office

Join millions of flexible spenders

Learn more about FSAs

People also ask

Employer FSA Questions

-

Where can I find more information about the cost of offering an FSA to employees?

Whether you have FSA questions about your small business or a larger company, we have answers. To request more pricing information for FSAs and DCFSAs, fill out our contact form or call us at 866.855.8908

-

What is considered an FSA-eligible expense?

You can use a flexible spending account to set aside money to pay for all eligible medical care expenses, including dental and vision expenses, as well as over-the-counter medications. Browse our full list of FSA-eligible items

-

What is the difference between an FSA and an HSA?

An FSA is an employer-sponsored plan, whereas a health savings account (HSA) is individually owned. Additionally, HSA eligibility requires enrollment in a high-deductible health insurance plan, while an FSA is compatible with most insurance plans. Compare FSA vs. HSA plans to see which is best for you.

-

What is the difference between a healthcare FSA and a limited purpose FSA?

A limited purpose FSA restricts eligible expenses to dental and vision expenses exclusively. Learn more about LPFSAs here.

-

What is the difference between a healthcare FSA and a dependent care FSA?

Healthcare FSAs allow the account owner to pay for all qualified medical expenses. Dependent care FSAs restrict eligible expenses to dependent care expenses exclusively. Read more about how a dependent care FSA works.

-

What happens to unused FSA funds?

Unused funds are forfeited to the employer, usually at the end of the plan year. Learn more about FSA rules.

Read more about FSAs

Explore our insights about flexible spending account (FSA) business solutions, best practices, and other benefits to keep your employees happy and healthy.

Article

Answers for the top 10 FSA questions

Article

HSA vs. FSA vs. HRA healthcare account comparison

Article

FSA Guide

HealthEquity does not provide legal, tax or financial advice.

1Accounts must be activated via the HealthEquity website in order to use the mobile app.Return to content

COBRA/Direct Bill Employer login

Please refer to your Client Welcome email for the URL of your specific COBRA/Direct Bill Employer login page.

Follow us