For Business | Health Savings Account

Health savings for employers

Offer your employees the best possible HSA experience

through a seamless process powered by HealthEquity.1

HSA Solutions

A simpler HSA solution is possible. Maximize your member HSA satisfaction through a simple and rewarding experience.

Fast onboarding

Implement your HSA program quickly to support your employees in achieving health and financial security.

Seamless

Transfer member files from any platform or payroll vendor.

Customizable

Setup employer account preferences in minutes.

Efficient

Execute bulk HSA transfers.

Powerful integrations

It’s easier than ever to customize your plan design, manage benefits, and deliver a smooth experience for employees.

Automated

Accelerate claims and payments.

Practical

Put retirement and HSA account information side-by-side.

Easy

Streamline day-to-day administration.

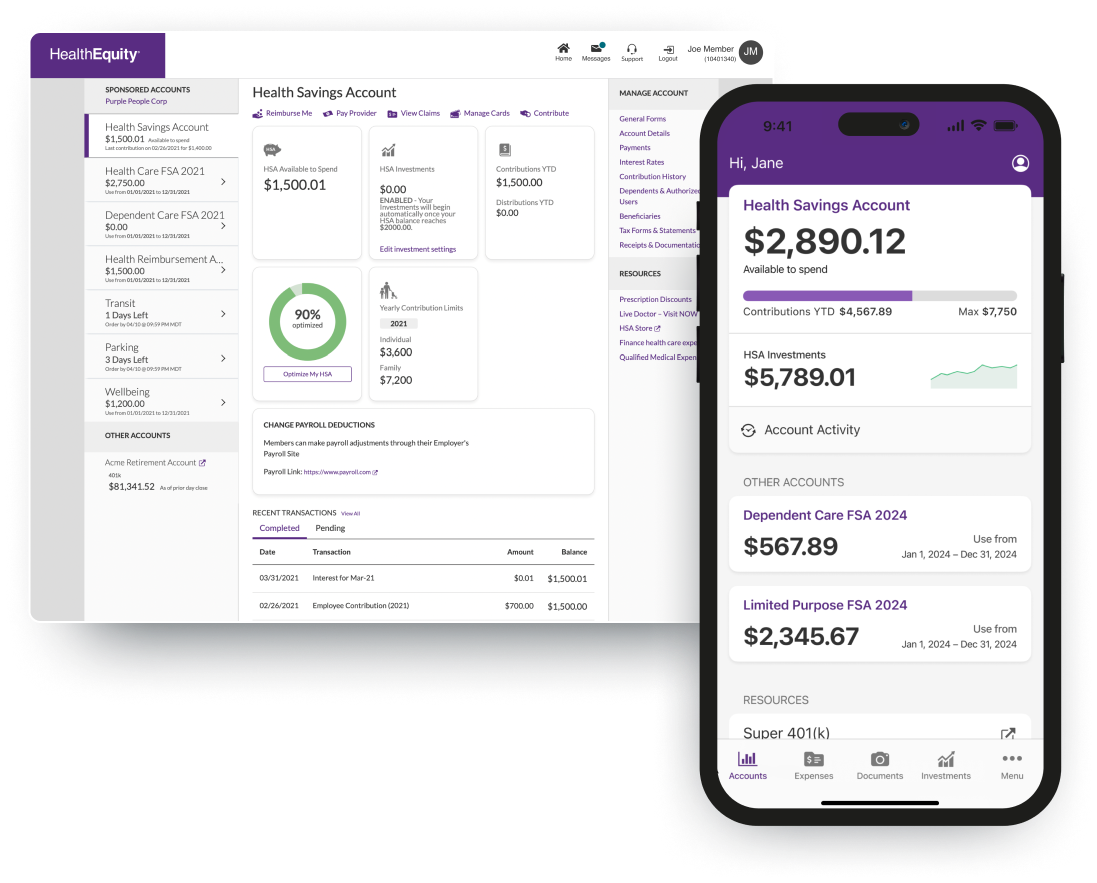

Single-view dashboard

Our unified dashboard lets members perform basic account functions directly from the home screen.

Mobile

Manage everything from the palm of your hand.

Convenient

Enjoy at-a-glance views of account balances, spending, claims status, and more.

Secure

Expect two-factor authentication and industry-standard encryption.

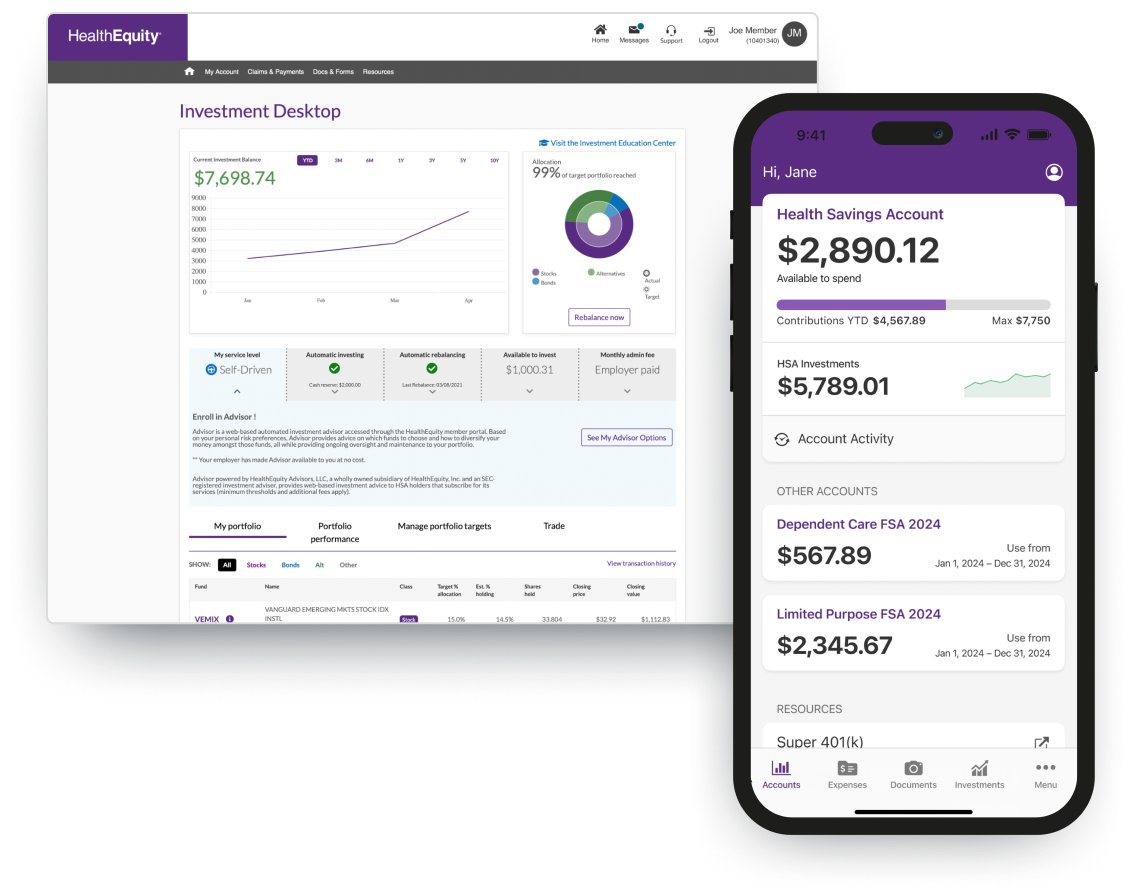

Intuitive investment desktop2

Intuitive navigation and seamless technology make HSA investing easier than ever.

Effortless

Automatically invest contributions and rebalance your portfolio.

Trusted

Choose from 33 low-cost Vanguard mutual funds.

Intelligent

Access personalized guidance and recommendations from HealthEquity advisors, LLC.

Engagement

Engage360

Get exclusive access to our comprehensive suite of engagement resources designed specifically for benefits professionals.

Engage360 HubOpen Enrollment Toolkit

Drive adoption

Take advantage of our huge library of flyers, webinars, and other resources you can use during annual enrollment and for new hires.

Explore the toolkitEngagement Packages

Maximize utilization

We’ll send members targeted emails throughout the year. Plus, you can use our content around the office and in your organization’s communications.

Access the packagesBest Practices

Refine and optimize

Sign up for monthly workshops and webinars that will help you make a bigger impact with less effort.

Start learningHealthEquity is the largest HSA provider3

We are partners in your success. Your employees are our priority and we seek to proactively help members for quick and easy access to improve health and financial outcomes.

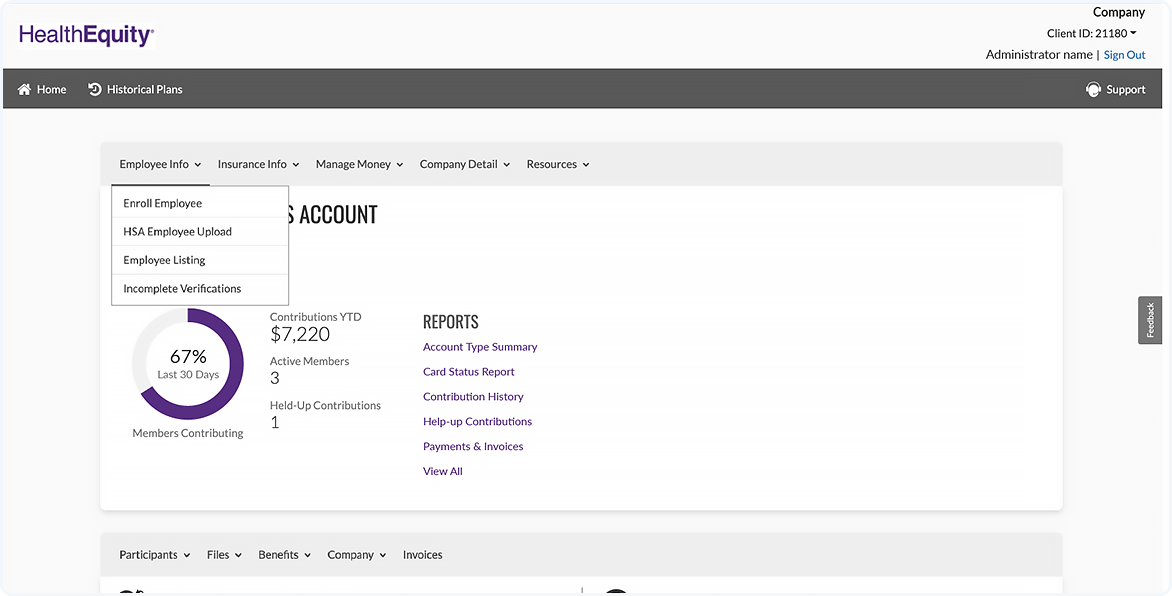

HSA Administration

Benefits manager dashboard

Streamline workflows and get complete visibility into your

entire program.

Manage enrollment

Ensure employees are enrolled in the right plan for the right period of time.

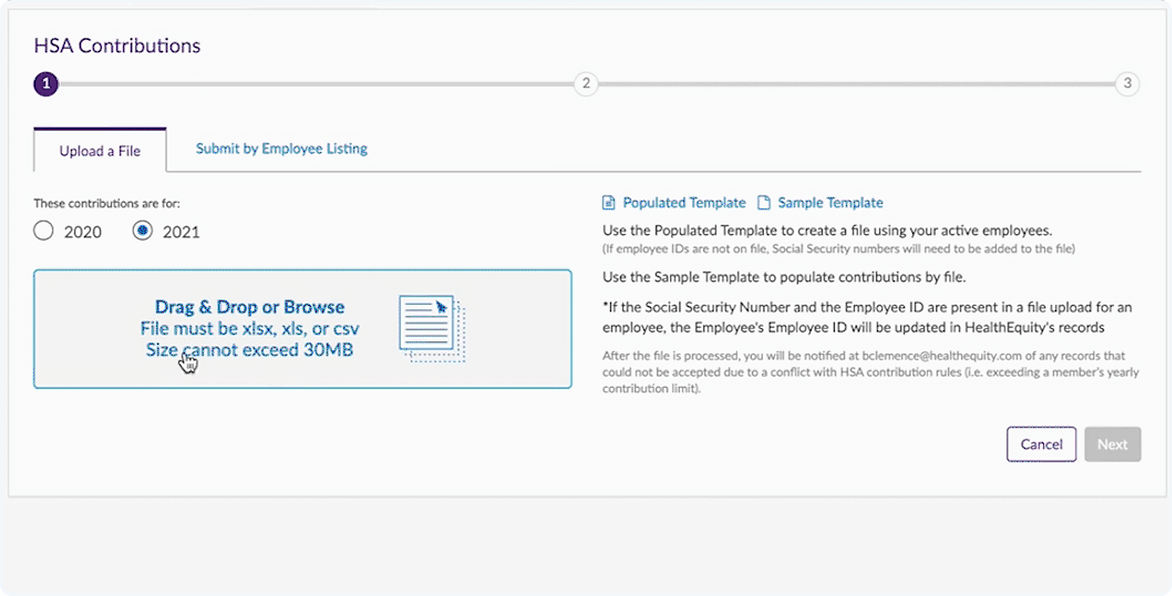

Make contributions

Use roster and historical data to simplify every aspect of contribution management.

Run reports

Pull status reports for card mailing, account activations, and potential over contributions.

View and pay invoices

Review and pay outstanding invoices, with views categorized by fees, contributions, and more.

Our HSA is the total package

Design the plan that is right for you and your people. Our account management team works with your retirement, health plan, and business admin partners.

See the dashboard

in action

Discover how we empower you to deliver the best HSA experience.

HSA for Individuals

Not a business?

Discover how we make it easy to manage the high cost of healthcare.

Opening an HSA Explore our HSA GuidePeople also ask

Employer HSA Questions

-

Do employers pay HSA?

Employers can choose to contribute a set amount or match contributions made by employees. There are annual limits set by the IRS as to how much an employee can contribute to their HSA.

-

How much do employers pay for HSA?

The average amount that employers match for an employee’s HSA is around $600 with a maximum contribution of $3,400.

-

Why would an employer offer an HSA?

Employers benefit from lower payroll taxes, higher employee satisfaction, better recruitment for prospective employees, optimized employee retention, and overall lower costs for health benefits.

-

How does an employer set up an HSA account?

HealthEquity will walk you through step-by-step throughout this process. You’ll want to determine eligibility and contributions, etc. Our advisors will pick the best plan for you and your people.

-

Is an employer HSA contribution taxable?

No, employer contributions aren’t included in income and are therefore not taxable to the employer or employee.

1HSAs are never taxed at a federal income tax level when used appropriately for qualified medical expenses. Also, most states recognize HSA funds as tax-deductible with very few exceptions. Please consult a tax advisor regarding your state’s specific rules.Return to content

2Investments are subject to risk, including the possible loss of the principal invested and are not FDIC or NCUA insured, or guaranteed by HealthEquity, Inc. HSA holders may select Vanguard funds for investment through the HealthEquity investment platform but HealthEquity, Inc. does not provide investment advice. HealthEquity Advisors, LLC, a wholly owned subsidiary of HealthEquity, Inc. and an SEC-registered investment adviser, provides web-based investment advice to HSA holders that subscribe for its services (minimum thresholds and additional fees apply). Registration does not imply endorsement by any state or agency and does not imply a level of skill, education, or training. Investing may not be suitable for everyone. You should carefully consider the investment objectives, risks, charges and expenses of any mutual fund before investing. A prospectus and, if available, a summary prospectus containing this and other important information can be obtained by visiting the Vanguard website at vanguard.com. Please read the prospectus carefully before investing.Return to content

32022 Year-End Devenir HSA Research Report, March 2023 https://www.devenir.com/research/2022-year-end-devenir-hsa-research-report.Return to content

4As of January 31, 2025, according to a 2025 HealthEquity Year-End Sales Report.Return to content

HealthEquity does not provide legal, tax or financial advice.

COBRA/Direct Bill Employer login

Please refer to your Client Welcome email for the URL of your specific COBRA/Direct Bill Employer login page.

Follow us